If someone owns a public land or building, the Philippine government imposes a tax against the property. The tax levied on a real estate is termed as ‘real property tax’. Real property tax (RPT) is a yearly tax which shall accrue on January 1st of the year. The legal basis of the real property tax is found in the Title II of the Local Government Code, Republic Act (R.A) No. 7160. This article provides an overview on the nuts and bolts of real property tax (RPT) in the Philippines.

Who Should Pay?

Owner/s of any form of real estate should pay real property tax. People who hold apartments, machineries, condominium units and similar others are not exempted by the law, and therefore obliged to pay the RPT.

Where to Pay?

Real property taxes are to be paid at any municipal treasurer’s office where the real property is situated.

When to Pay?

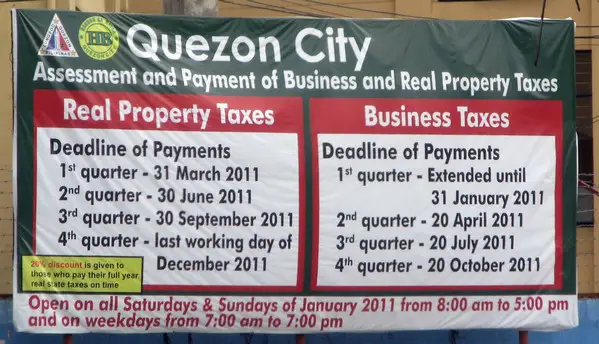

Real property tax is paid annually (on or before 31 March), 4 quarterly installments, or in advance. If payment is made before the due date, the tax payer is granted up to 20% of the annual tax. Nevertheless, it should be noted that these monetary incentives vary on the location. For quarterly payments, the tax payer should be able to pay the tax due on or before the last day of every quarter – that is, 31 March, 30 June, 30 September and 31 December.

What Happens if I Pay After the Set Deadline?

A 2% interest per month shall be imposed if failure to pay real property tax. The interest accrues until the due amount is fully paid.

What are the Aftermaths of Not Paying Real Property Tax?

The following are the legal consequences when failure to pay the real property tax:

- Interest. As mentioned above, interest rate starts at 2% per month and continues to accumulate until paid fully. The maximum period for interest is 36 months.

- Penalties. In addition to interest, incurred monetary penalties include late fees, administrative fees and collection fees.

- Garnishment. Garnishment is a legal procedure wherein the court orders to cut a portion of the tax payer’s wage or savings account to pay the taxes due.

- Tax lien. This is the provision of right to the government to seize the property as a consequence of not paying real property tax.

How to Compute Real Property Tax?

Computation of real property tax in the Philippines is based on the real property tax (RPT) rate multiplied by the assessed value. The RPT rate is contingent upon the coverage of the property. To illustrate, maximum RPT rate of properties located in cities and municipalities within the Metro Manila is 2% while only 1% in provinces. On the other hand, assessment levels are variable according to land or building structures. For example, a residential house has 20% assessment level while 50% for a commercial property.

Formula: real property tax x assessed value = real property tax

Example:

Assessed value = P500, 000

RPT rate in Makati – 1.5%

P500, 000 x 1.5% = P7, 500

Therefore, the basic real property tax due is Php7, 500.

The govt should not impose an additional tax on its constituents as the government charging taxes from people’s income and other taxes to name a few.